Leverage construction cash flow management software to precisely forecast 3-6 month financial trends, aiding in timely project planning and payment scheduling.

Ensure sustainable growth by judiciously allocating resources for new equipment or enlarging your business development team without straining your budget. Cash flow forecasting tools allow you to assess the feasibility of reinvestments and new project undertakings. Be proactive in spotting potential issues and gain in-depth insights into your company's cash flow dynamics with our dedicated construction cash flow software.

Keeping a close eye on your business's financial dynamics is crucial to effectively tracking expenses. Leveraging construction cash flow software ensures a consistent influx of funds to sustain your operations. Engage in monthly evaluations with our detailed reports to foresee and strategize for substantial expenditures. Gain clear visibility into the components of your costs and maintain a healthy cash reserve to meet all payment deadlines seamlessly.

A positive cash flow is indicative of a thriving and profitable business. Utilize our construction cash flow software to understand your financial inflows and outflows, ensuring smooth transactions when settling payments. Our tool provides the resilience needed to navigate the ever-changing landscape of construction work costs and material prices, helping you maintain a cash position and sufficient liquidity to adapt promptly to these fluctuations.

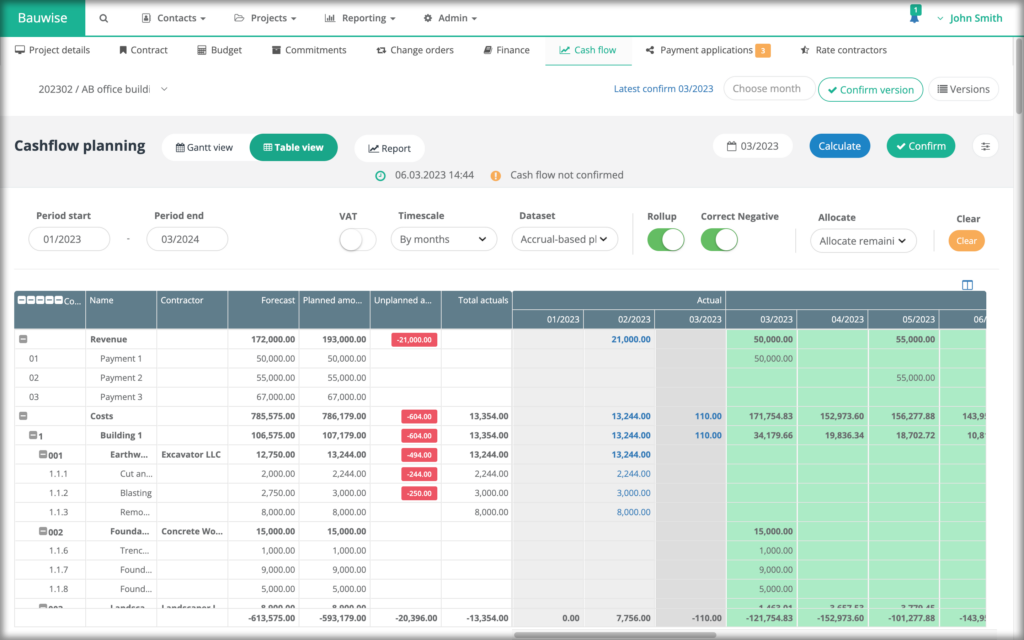

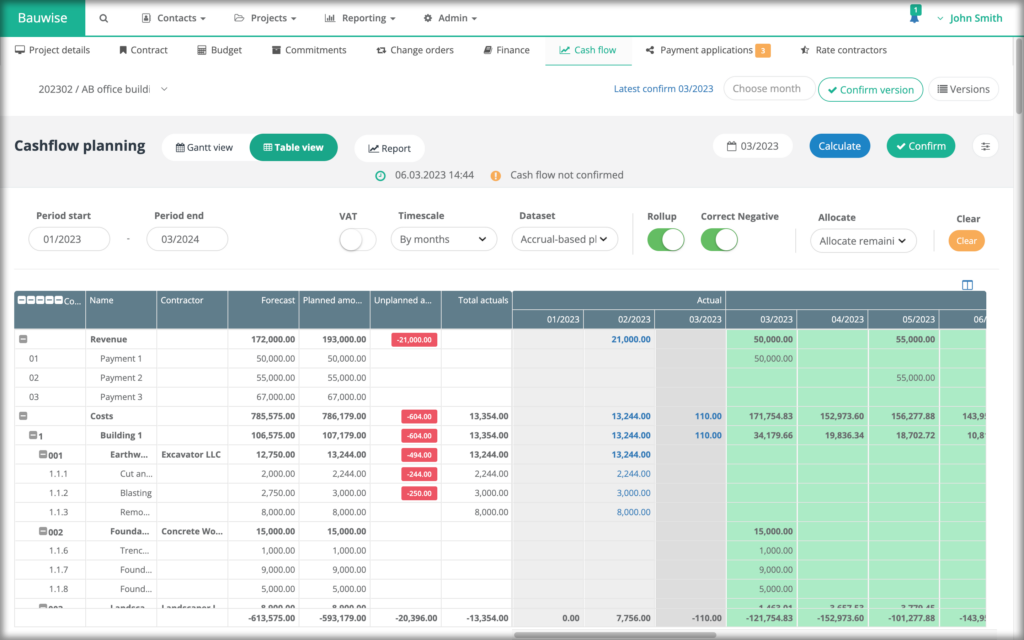

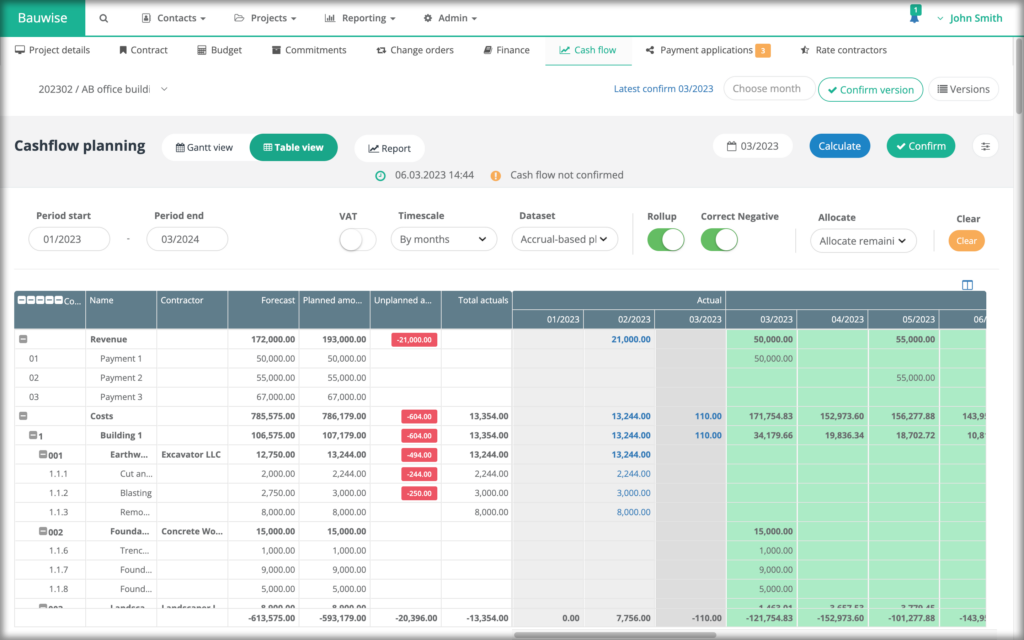

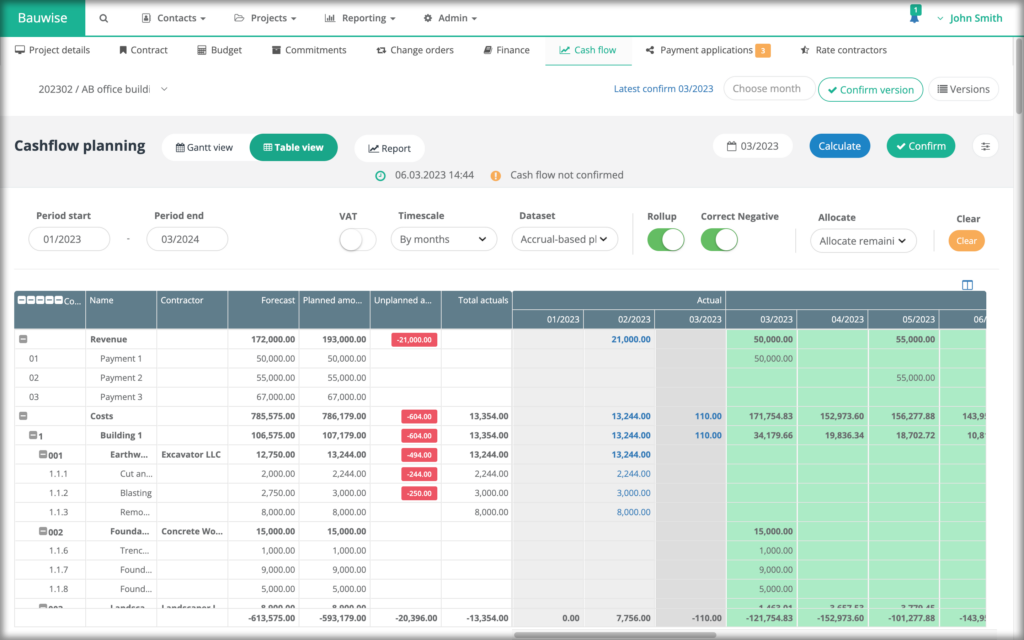

Correctly forecasting cash flow is essential for the success of construction projects, allowing for predicting financial necessities months ahead. Bauwise facilitates streamlined management of your firm’s cash flow while enabling detailed forecasting for each project, helping to prevent budget overruns. The tool supports:

Crafting feasible projections based on budget, revenue, expenses, or commitments.

Generating precise forecasts to visualize planned and actual expenditures, clarifying your business’s financial standing.

Identifying potential cash flow issues before reaching the project’s conclusion.

Accurately estimating the costs associated with each project.

Utilize a single dashboard to track all approved sales and purchase invoices.

Gain a clear snapshot of period or project-specific payables to plan cash flow efficiently.

Monitor your project’s monthly cash flow.

Quickly assess if project revenues are within the budget through a centralized view.

Instantly spot if monthly approved costs surpass project revenues.

Identify punctual and delayed customer payments promptly.

Identify cash flow needs by using construction cash flow forecasting software.

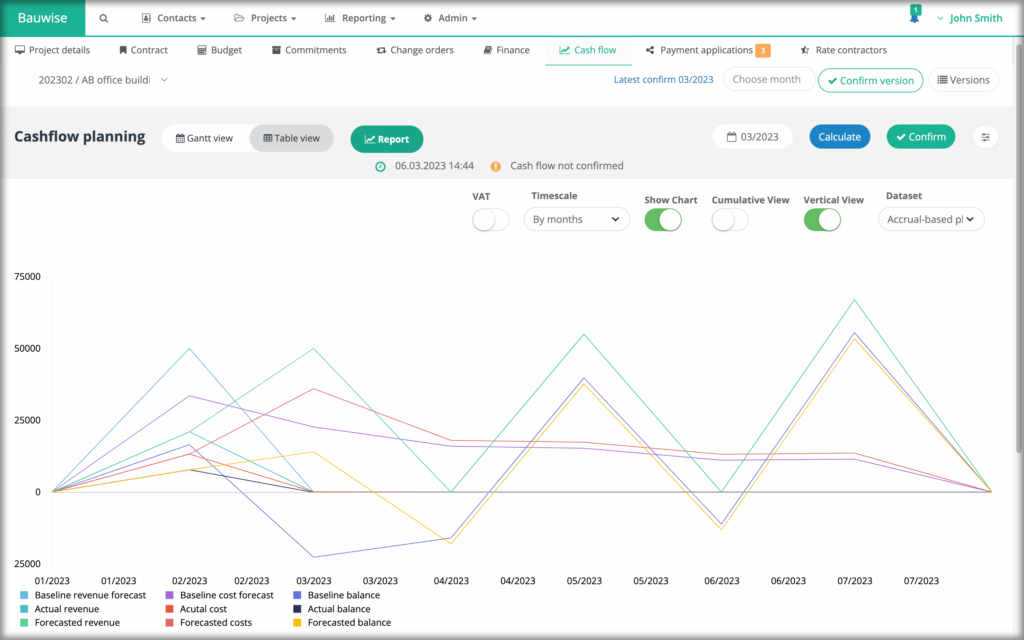

As project managers handle the approval of sales and purchase invoices, Bauwise construction cash flow software effortlessly aids in tracking the cash flow both on a month-over-month basis and in the general timeframe.

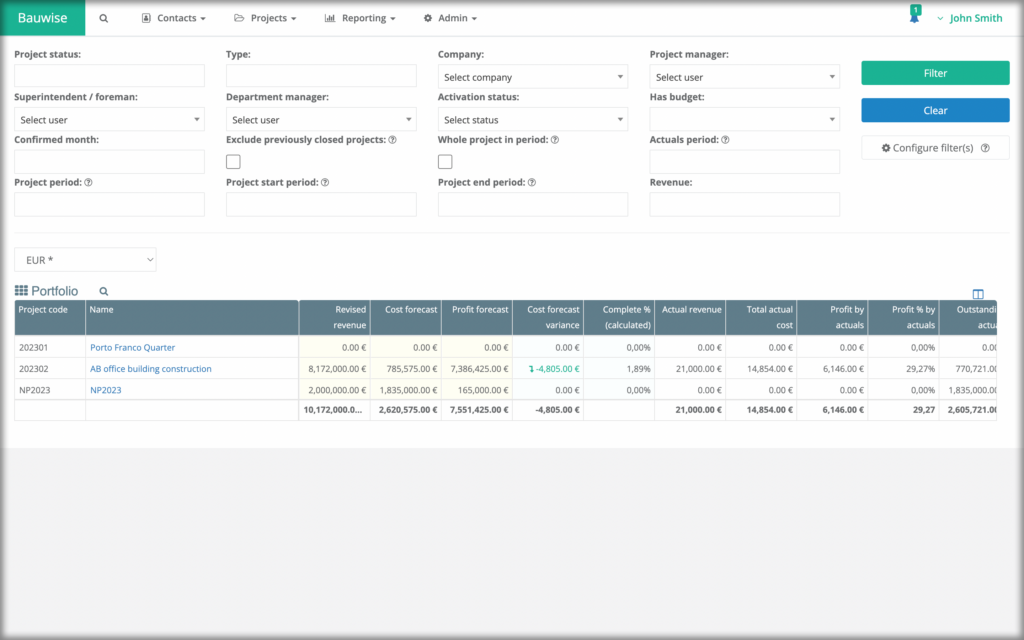

Leverage the project dashboard to instantly see project costs and verify if the project’s revenue surpasses the budget, visualized through a comprehensive historical graph that illustrates month-over-month cash flow.

Be alert to moments where monthly sanctioned costs outstrip the revenue for a project in your portfolio, allowing for swift, responsive actions.

Utilize construction cash flow software to analyze financial statements effectively, facilitating a clear understanding of potential cash inflows and outflows. This tool empowers your business to foresee issues and increase revenue through detailed insights accessible anytime, anywhere. It assists in:

Ensuring precise cash flow forecasting prepares you for substantial dialogues with stakeholders and supports budget adherence. Regular, timely payments bolster your rapport with top suppliers, helping avoid cash deficiencies and guaranteeing a sufficient bank balance to cover all impending expenses. The strategy involves:

Fulfilling payment obligations to staff and contractors wholly and punctually.

Nurturing positive relationships with suppliers.

Collaboratively overseeing cash flow by sharing real-time dashboard updates with pertinent team members, including managers, CFOs, accountants, and financial associates.

Manage construction project’s cash flow easily and avoid negative cash flow.

Undertaking a detailed cash flow analysis for construction projects assists contractors in various ways, including:

Strategizing financial aspects for a project.

Evaluating the potential ROI of investing time in a project.

Enumerating the requisite resources for project completion.

Projecting both the costs and anticipated revenue timelines.

Check the company’s cash flow anytime and make accurate cash flow projections.

A thorough cash flow analysis furnishes a deeper comprehension of the prospective cash outflows and inflows, fostering a better understanding of a project’s financial dynamics. Utilizing a construction project cash flow chart allows for a comprehensive view of the financial needs and helps assess the project’s alignment with your business objectives.

Maintaining precise cash flow evaluations safeguards your business’s financial stability consistently.

Cash flow management of construction projects has never been easier. Get accurate cash flow statement, identify cash flow problems, and forget manual cash flow analysis. Accurate cash flow projections are crucial for avoiding construction cash flow problems. Generate cash flow statements by using Bauwise cash flow forecasting software.

More than 10 000 projects managed by using Bauwise

To create a cash flow forecast for your construction business, gather all necessary financial data, including historical financial statements, current bank statements, accounts receivables, and payables. Decide on a forecast period, which can be monthly, quarterly, or yearly.

Next, estimate your cash inflows, considering client payments and investment income. Similarly, anticipate cash outflows, encompassing operational expenses, material purchases, and loan repayments. Record all transactions expected precisely in a forecasting tool or spreadsheet.

Analyze this data to discern patterns and make informed business decisions. Regularly update your forecast based on actual results to maintain its accuracy. Implementing tools like Bauwise to streamline this process is beneficial, and consulting with a financial expert can further enhance the forecast’s accuracy. A sound cash flow forecast aids in steering clear of financial hurdles and sustaining business viability across various project phases.

Cash flow forecast software for the construction industry is a digital tool designed to help construction businesses project their future financial position by analyzing expected cash inflows and outflows over a specified period. This software can offer functionalities like automatic data import from various accounting platforms, real-time cash flow analysis, project-by-project financial overview, and predictive analytics leveraging historical data. Famous examples as of my last update include QuickBooks, Sage, and Bauwise, which can facilitate comprehensive financial planning and management for construction projects, helping to prevent budget overruns and maintain financial stability. It’s recommended to research the latest offerings and reviews to choose the best solution for your specific needs.

Maintaining cash flow in a construction project involves careful planning and regular monitoring to ensure the project remains financially viable. Here are the key steps and strategies to sustain cash flow:

Accurate Estimations: Before starting a project, estimate the costs, including material, labor, and overhead costs.

Timely Invoicing: Invoice clients promptly and ensure that the payment terms are clear to facilitate quick payments.

Expense Management: Keep a close watch on your expenses and avoid unnecessary costs. Negotiate favorable payment terms with suppliers to maintain a positive cash flow.

Emergency Fund: Set aside a contingency fund to cover unexpected costs that may arise during the project.

Progressive Payment: Adopt a progressive payment schedule, where clients make payments in installments as different project milestones are achieved.

Cash Flow Forecasting: Utilize cash flow forecasting tools to anticipate future cash flow patterns and make informed financial decisions.

Monitor Receivables: Regularly monitor accounts receivables and follow up on overdue payments.

Cost Control: Implement cost control measures to prevent overspending and to stay within the budget.

Flexible Financial Planning: Be prepared to adjust your financial plans based on the actual cash flow and project progress.

Professional Advice: Seek professional financial advice to manage complex financial situations effectively.

Implementing these strategies can help maintain a healthy cash flow in a construction project, ensuring its completion without financial hiccups.

Creating a cash flow forecast involves estimating future cash inflows and outflows over a specified period. Here are the elements typically included in a cash flow forecast:

Inflows:

Sales revenue

Investment income

Loans received

Asset sales

Grants or subsidies

Outflows:

Operating expenses (e.g., rent, salaries)

Supplies and material costs

Loan repayments

Tax payments

Capital expenditures (e.g., equipment purchases)

Marketing and advertising costs

Research and development costs (if applicable)

Other:

Emergency fund allocation

Net cash flow (total inflows minus total outflows)

Opening and closing cash balances for each period

It’s also essential to note the forecast frequency (e.g., monthly, quarterly) and any assumptions made in the forecast, using historical data for more precise projections where possible.

Improving cash flow in a construction business involves managing your income and expenses efficiently. Here are a few strategies to enhance cash flow:

Prompt Invoicing: Bill clients promptly and encourage faster payments through incentives or small discounts.

Expense Management: Regularly review and manage your expenses, avoiding unnecessary costs.

Supplier Negotiations: Negotiate favorable payment terms with your suppliers, possibly extending payment durations without incurring penalties.

Cost-Efficient Procurement: Adopt cost-efficient procurement strategies, like bulk purchasing, to avail discounts.

Interim Payments: Arrange temporary payment contracts for long-term projects to maintain a steady cash flow.

Contingency Planning: Set aside a contingency fund to handle unexpected costs without straining the cash flow.

Technology Integration: Leverage technology, like construction cash flow software, to get real-time insights and efficiently manage cash flows.

Efficient Inventory Management: Maintain an optimal inventory level to avoid unnecessarily getting funds tied up.

Credit Management: Manage your credit effectively, avoiding bad debts and encouraging customers to stick to the payment terms.

Regular Cash Flow Forecasting: Regularly update your cash flow forecasts to reflect the current financial state and plan accordingly.

Implementing these strategies can help construction company maintain a healthy cash flow, ensuring the financial stability of your construction business.

try now

The typical learning time is just two sessions, while our software can save you up to 4 workdays per month

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies.