When managing construction change orders, accurately determining the actual costs is crucial and typically involves three categories: direct, indirect, and consequential costs. Disagreements often arise due to varying perceptions of what is fair and reasonable regarding these costs. Direct costs are usually more straightforward and frequently included in change order requests. However, indirect and consequential costs often face issues such as lack of general acceptance, inexperience, and poorly defined standards, leading to disputes in many projects.

Research indicates that on major projects, change order costs can represent 10 to 15 percent of the contract value, and a higher frequency of changes can reduce productivity by 10 to 30 percent. The timing of a change order also plays a critical role in its cost impact. Early requests in the construction process typically incur lower costs than those made after work has begun or been completed, mainly when changes affect subsequent work, leading to a cascade of additional expenses.

For optimal transparency and fairness, contractors must itemize their prices in detail in any change order proposal. This approach allows owners to understand the rationale behind the costs, ensures there are no hidden expenses, and verifies that the profit margin on the order does not exceed that of the contract. While sometimes simpler, lump-sum proposals can obscure these details and should be approached with caution to maintain transparent and fair financial dealings.

Table of Contents

1. Direct costs

Direct costs in construction change orders encompass a range of easily identifiable and quantifiable expenses, being tangible and often visibly influencing project outcomes. These costs typically include labor, materials, equipment, and other expenses directly related to the change. It’s important to consider the hourly rates for labor and material costs and the broader scope of direct costs often overlooked, impacting overall profitability.

These additional expenses might include the time and resources spent analyzing, discussing, estimating, managing, and presenting changes to the owner or engineer. Other drawings, construction management plan revisions, or cost analyses are direct costs, as are composite labor rates for safety meetings, cleanup, supervision, and work guarantees, including employer burdens.

For materials and equipment, it’s crucial to recognize that prices can vary over time and may incur separate delivery costs. When calculating these costs, consider factors like price quotations from vendors, transport, storage, handling, and inspection of materials. Labor costs should include work hours and rates, supervision, benefits such as sick pay, insurance, retirement, and employer taxes.

Both rented and owned equipment require different approaches to equipment costs. For rented equipment, calculate costs by determining an hourly rate and adding operating expenses like fuel and lubricant. For owned equipment, consider the contract’s pricing method or established equipment cost recovery rates, factoring in the purchase price, sales tax, depreciation, insurance, licensing, maintenance, overhauls, repairs, and financing costs.

Overall, a thorough understanding and careful calculation of these direct costs are essential for accurately assessing the financial impact of construction change orders.

2. Indirect costs

Indirect costs in construction projects, particularly in the context of change orders, encompass overhead, profit, and markup. These are essential components for contractors to consider to ensure accurate pricing and financial viability.

Overhead Costs

Overhead refers to the general administrative expenses incurred in operating a business. While not directly linked to any specific project, these costs are essential for the company’s overall functioning. They include expenses such as office rent, utilities, staff salaries and benefits, advertising, training, and various administrative costs.

Calculating the overhead percentage is a key aspect. This is done by dividing the company’s total annual revenue by its total overhead costs, which provides the overhead percentage:

Total Annual Revenue $ ÷ Total Overhead $ = Overhead %

However, it’s important to note that overhead costs can vary significantly based on the company’s size, with larger companies often incurring higher overhead expenses.

For instance, while a standard overhead cost is often considered to be around 10%, research by ELECTRI International indicates that for electrical contractors, this figure is closer to 19.16%. This percentage then translates differently when applied to change order costs. Here is the formula to calculate overhead on direct costs only:

(Overhead % ÷ direct cost %) = markup %

or

Overhead % ÷ (1 – Overhead %) = % of Direct Change Order Costs

Thus, an overhead of 19.16% leads to approximately 23.7% when calculated for direct change order costs:

0.1916 ÷ (1 – 0.1916) = 23.7% or 0.1916 ÷ 0.8084 = 23.7%

Profit: Net and Gross

In the context of indirect costs, profit is categorized into net profit and gross profit. Net profit is what the contractor earns after deducting all costs, including overhead, typically ranging from 5 to 10 percent of revenue. Gross profit, on the other hand, is calculated before subtracting these costs.

Suppose a contract specifies a profit margin of 6% for all change orders. The same method used for calculating overhead should be applied to accurately translate this into a markup on total costs, including overhead.

The formula for this conversion is:

Profit Percentage÷Total Costs including Overhead Percentage

or in this case, 0.06÷0.94=6.38%

By applying a markup of 6.38% to the total costs, the desired profit margin of 6% can be achieved. Notably, commonly used figures like 10% for overhead and 5% for markup, totaling a 15% combined overhead and markup, or even a 10%/10% split, may not adequately cover the actual costs involved in change orders.

Markup

Markup is the additional percentage added to the costs (both direct and overhead) to derive a profitable selling price. This is crucial in change order pricing and generally stands around 15 percent. However, to achieve a specific profit margin, such as 20 percent, the markup must be adjusted accordingly, often higher than the desired profit margin due to the non-linear relationship between profit margin and markup percentage.

Competitive and Economic Influences

The competitive landscape and economic conditions significantly influence markup and profit margins. For example, contractors might opt for lower profit margins or nominal markups during economic downturns or in highly competitive markets, especially on commodity items.

Challenges in Indirect Cost Calculation

A common issue in the industry is the lack of a strong grasp on indirect costs, leading to underpricing. The typical ranges for overhead and markup in contracts (5% to 10% each) are often arbitrary and may not accurately reflect the actual costs, leading to inadequate recovery of overhead and profit.

To calculate a more precise overhead percentage, contractors should sum up all non-project-specific expenses and divide this by the total annual sales, resulting in a more accurate overhead percentage. For example, if the overhead is 19% and direct costs constitute 81% of the total cost, the correct markup to recover overhead would be approximately 23.5%.

Similarly, the agreed profit percentage in the contract must be appropriately marked up for profit calculations to cover all costs, including overhead. A formula similar to the one used for overhead calculation ensures that the actual profit margin is achieved.

In conclusion, understanding and accurately calculating indirect costs, such as overhead, profit, and markup, are vital for contractors to price change orders correctly. This requires a detailed understanding of business expenses, the competitive environment, and the specific dynamics of each project.

3. Consequential Costs

Consequential costs in construction change orders are indirect expenses that arise as a direct outcome of the change order. They are termed “consequential” because they represent the ripple or cumulative effects resulting from modifications to the project. Recognizing and accurately accounting for these costs is crucial for a project’s financial integrity and minimizing disputes.

Types of Consequential Costs

These costs are multifaceted, encompassing both hard and soft expenses. Key elements include:

- Project Delays: Extended timelines can lead to increased costs.

- Overtime: Additional labor hours required to meet revised deadlines.

- Training: Costs associated with training personnel to adapt to changes.

- Morale and Crew Reassignments: The impact on team morale and the logistics of reassigning staff.

- Inefficiency: General loss of productivity due to changes.

- Stacking of Trades: When multiple subcontractors work in a confined space, leading to reduced labor productivity.

- Safety and Access Issues: Trade stacking can introduce safety hazards and impede material access.

- Dilution of Supervision: Change orders may stretch supervisory roles thin, affecting overall project supervision.

- Site Access Interference: Modifications in the project can lead to logistical challenges in accessing the site.

- Impact of Seasonal and Weather Conditions: Changes might expose the project to adverse weather or seasonal impacts.

Calculation and Documentation

Calculating the impact of these factors requires a systematic approach, often guided by industry literature, surveys, court cases, and case studies. Resources like the Mechanical Contractors Association of America’s Toronto Change Order Protocol and Andrew Civitello’s Contractor’s Guide to Change Orders provide valuable insights into this process.

It is essential to document potential consequential costs meticulously in the change order. This documentation should detail and substantiate the calculations, providing a clear rationale for the additional expenses.

Managing Risks and Ensuring Profitability

Historically, consequential costs have been a contentious issue in change orders. However, contractors can significantly reduce risks associated with change orders by clearly documenting and substantiating these costs. Understanding and including these costs in change order pricing is not just about recovering expenses; it’s about ensuring a profitable and sustainable future for the industry. Therefore, effective management of consequential costs is critical to achieving financial stability and success in construction projects.

For additional reading, here is a document about pricing of construction change orders from Case Western Reserve University and document about construction change order statistics.

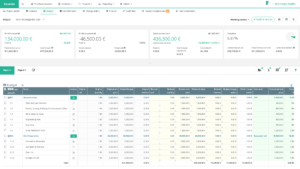

Streamline your change orders with Bauwise change order management software

Bauwise offers user-friendly change order software that simplifies collecting, tracking, processing, and approving change orders. With its intuitive interface, you can easily create, modify, and manage change orders, ensuring that all modifications are accurately documented and efficiently processed. The software provides real-time updates and alerts, keeping all stakeholders informed and aligned when it is time to review and approve change orders. Try Bauwise for free today!

Written by

Taavi Kaiv

Taavi Kaiv is a construction specialist with over ten years of experience in the construction industry. Taavi is an accomplished construction project manager with many successful projects that have been completed under his guidance. Taavi holds a master’s degree in construction management from the Tallinn University of Technology. View profile

Related posts

Read our articles where you can find useful and relevant information about construction change orders: