In this guide, we’ll explain everything about construction invoices and answer the basic questions people usually have. You’ll learn what a construction invoice is, what should be on it, what types of invoices there are, and how to write them correctly. As a bonus, we will provide you with a free construction invoice template. Let’s get started and make sure you understand the basics of construction project invoices!

Table of Contents

What Is a Construction Invoice?

A construction invoice is a detailed bill issued by contractors, subcontractors, suppliers, or any professional in the construction industry to their clients or customers for services or materials provided. It serves as a formal request for payment, outlining the specifics of the work completed or goods supplied during a construction project. Beyond its primary function of facilitating payment, a construction invoice also serves as an essential document for accounting, tax, and legal purposes, both for the issuer and the recipient. Here’s a more in-depth look at what constitutes a construction invoice and its significance:

Key Components

A typical construction invoice includes several critical elements to ensure clarity, legality, and ease of processing. These components include:

- Header: Identifies the document as an invoice, often accompanied by the issuer’s logo.

- Contact Information: The names, addresses, and contact details of the issuer (contractor, subcontractor, or supplier) and the recipient (client or general contractor).

- Invoice Details: A unique invoice number for tracking purposes, the date the invoice was issued, and the payment due date.

- Project Description: Information about the construction project, including its name, location, and a brief description of the work or services provided.

- Itemized List: Detailed breakdown of all the services and materials provided, including quantities, unit prices, and total costs for each item.

- Cost Summary: The subtotal before taxes, applied taxes, discounts (if any), and the total amount due.

- Payment Terms: Instructions on how the payment should be made, including accepted payment methods, payment deadline, and penalties for late payment, if applicable.

- Additional Information: This may include notes of appreciation, legal disclaimers, or other relevant details about the services or project.

Purpose and Use

The primary purpose of a construction invoice is to request and facilitate payment from the client to the issuer for completed work or supplied materials. However, its use extends beyond this simple transaction:

- Financial Documentation: Serves as an official record of the income for the issuer and expenses for the client, crucial for financial reporting, budgeting, and auditing.

- Legal Evidence: In case of disputes or legal action, invoices can indicate agreed-upon prices, services rendered, and payment terms.

- Tax Compliance: This helps both parties comply with tax regulations, as it includes detailed information about taxable services and materials.

- Project Management: This position assists in tracking project costs, budget compliance, and work progress, forming an integral part of the project’s financial management.

What types of construction invoices are there?

In the construction industry, invoicing is critical to managing finances, ensuring that payments are processed efficiently for the services and materials provided. There are several types of construction invoices, each serving a specific purpose based on the nature of the billing, the project phase, and the contract terms. Understanding the different types of construction invoices can help both contractors and clients manage payments more effectively. Here are the primary types of construction invoices used in the industry:

1. Standard Invoice

- Purpose: This is a general invoice used in various industries, including construction, for straightforward transactions. It details the work done or materials supplied and the total amount due.

- Use Case: Ideal for one-time jobs or simple projects requiring a single payment upon completion.

2. Progress Billing Invoice

- Purpose: For long-term projects, progress billing invoices are used to request payments at various stages of the project. These invoices are based on the percentage of work completed or specific milestones reached.

- Use Case: Suitable for large construction projects that take months or years, allowing contractors to maintain cash flow throughout the project duration.

3. Time and Materials (T&M) Invoice

- Purpose: When projects are billed based on the actual time spent on the work and the materials used, a T&M invoice is issued. It lists the labor hours, labor rate, and cost of materials.

- Use Case: Used when the scope of the project cannot be accurately estimated upfront or when changes are expected during the project.

4. Cost-Plus Invoice

- Purpose: Similar to T&M invoices, cost-plus invoices cover the actual costs of materials and labor, but they also include an additional percentage or fixed fee representing the contractor’s profit.

- Use Case: This is appropriate for projects where the contractor and client agree that the contractor will be reimbursed for all costs plus a profit margin.

5. Fixed Price Invoice

- Purpose: This invoice is issued for projects with a fixed-price contract and requests payment for a previously agreed-upon total amount. The price does not change regardless of the actual costs incurred.

- Use Case: Best for projects with a well-defined scope where the costs can be accurately estimated upfront.

6. Retainage Invoice

- Purpose: In some contracts, a certain percentage of payment is withheld until the project or a significant portion of it is completed to the client’s satisfaction. This invoice is for the release of the retained amount.

- Use Case: Common in large projects to ensure contractors or subcontractors complete their work satisfactorily before receiving full payment.

7. Change Order Invoice

- Purpose: If there are any changes to the original contract terms, such as additional work or modifications to the scope, a change order invoice is issued to cover these extra costs.

- Use Case: This is necessary when the project scope changes after the work has started, requiring adjustments to the original contract and billing.

The variety of construction invoices reflects the diversity and complexity of projects in the construction industry. Each type provides clarity and transparency in financial transactions, catering to different contract arrangements and project requirements. Understanding these invoice types is crucial for contractors and clients to manage payments effectively, ensuring a smooth financial flow throughout the project lifecycle.

What should be included in a construction invoice?

A construction invoice should include several key components to ensure clarity, prevent disputes, and promote timely payments. Here’s a comprehensive breakdown of what should be included in a construction invoice:

1. Header

- Invoice Title: Clearly mark the document as an “Invoice” to avoid any confusion.

- Company Logo: If applicable, include your company logo for branding purposes.

2. Contact Information

- Your Company’s Information: Provide your construction company’s name, address, telephone number, email address, and any other relevant contact details.

- Client’s Information: Include the client’s name, company (if relevant), address, and other contact details. This ensures the invoice is directed to the right party and may help expedite payment.

3. Invoice Details

- Invoice Number: Assign a unique invoice number for tracking and reference purposes.

- Date of Issue: The date the invoice was created and issued.

- Due Date: Specify when the payment is due according to the agreed terms.

4. Project Description

- Project Name/Code: If applicable, include the name or code of the project.

- Location: The address or location of the construction project.

- Description: A brief overview of the project or services provided.

5. Itemized List of Services and Materials

- Provided services: List all the construction services provided. Include a detailed description for each service, such as the type of work, the date performed, and who performed it if necessary.

- Materials Used: Itemize the materials supplied, including quantities, unit prices, and the total cost for each material.

- Labor Charges: Detail the labor involved, specifying the number of hours worked, the hourly rate, and the total labor cost.

- Subcontractor Services: If subcontractors were employed, list their services separately, indicating the cost for each.

6. Cost Summary

- Subtotal: Before taxes and after any discounts, provide the subtotal of the services and materials.

- Taxes: Apply any relevant taxes to the subtotal.

- Discounts: If you’ve offered any discounts, subtract them here.

- Total Amount Due: The final amount the client owes you.

7. Payment Terms and Methods

- Payment Terms: Specify the payment terms (e.g., net 30 days upon receipt).

- Accepted Payment Methods: Indicate acceptable payment methods (checks, bank transfers, online payments).

- Late Payment Penalties: Detail any fees or interest for late payments.

8. Additional Information

- Notes Section: Use this area for any additional notes, such as a thank-you message, a reminder of the warranty period, or specifics about the work or payment terms.

- Legal Disclaimer: Some companies include a legal disclaimer or terms and conditions to protect their business.

9. Attachments

- Supporting Documents: Attach any relevant documentation, such as contracts, purchase orders, or work orders, that support the invoice details.

Including all these components in a construction, invoice ensures that the document is comprehensive, clear, and professional. This not only facilitates a smoother payment process but also helps maintain a good relationship with the client by providing all necessary details upfront. Always tailor the invoice to the project’s specifics and the agreement with the client, ensuring that all pertinent information is accurately reflected.

How do I create a construction invoice?

Creating a construction invoice involves several steps to ensure it is comprehensive, accurate, and professional. This process is crucial for facilitating timely payments and maintaining clear financial records. Here’s a step-by-step guide on how to create a construction invoice:

Step 1: Choose an Invoice Template or Software

- Template: You can start with a basic invoice template available in word processing software (like Microsoft Word or Google Docs) or spreadsheet software (like Excel or Google Sheets). Many free templates are available online that you can customize.

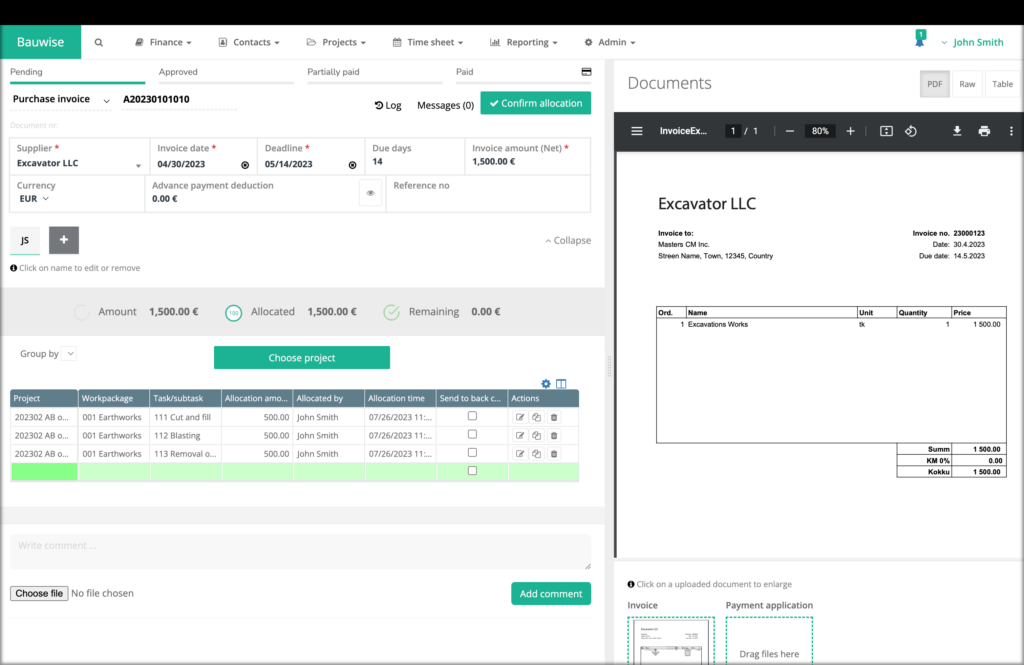

- Software: Consider using accounting or invoicing software designed for the construction industry, such as Bauwise construction invoicing software. These platforms can automate much of the invoicing process, track payments, provide approval workflows, and all the invoicing information, which is especially useful for managing multiple projects.

Step 2: Customize Your Invoice

- Header: Add your company’s logo and contact information at the top of the invoice. Clearly label the document as an “Invoice.”

- Client Information: Include the client’s name, address, and other contact details. Make sure it’s directed to the person or department responsible for payments.

- Invoice Details: Assign a unique invoice number for tracking purposes. Include the date the invoice is issued and the payment due date.

Step 3: Provide Project Details

- Project Description: Briefly describe the project, including its name and location, if applicable.

- Service and Materials List: Itemize the services provided and materials used. For each item, include a detailed description, the quantity or hours worked, the unit price or hourly rate, and the total cost.

Step 4: Calculate the Total Cost

- Subtotal: Add up the costs of all services and materials to provide a subtotal.

- Taxes and Discounts: Apply any relevant taxes and subtract any discounts offered to the client.

- Total Amount Due: Sum up the subtotal, taxes, and discounts to determine the total amount owed.

Step 5: Outline Payment Terms

- Payment Methods: Specify how you wish to receive payment (e.g., check, bank transfer, online payment).

- Payment Terms: Include the payment deadline (e.g., net 30 days) and any penalties for late payment.

- Additional Instructions: If necessary, provide payment details, such as bank account information for transfers.

Step 6: Add Additional Information

- Notes: Use a notes section for any additional information, such as a thank you message, reminders about warranty periods, or other comments related to the project or payment.

- Legal Disclaimer: Consider including a legal disclaimer or terms and conditions related to the services provided.

Step 7: Attach Supporting Documents

- Documentation: Attach any relevant documents, such as contracts, purchase orders, work orders, or timesheets, that support the invoice details and help justify the charges.

Step 8: Review and Send

- Review: Double-check the invoice for any errors or omissions. Ensure all information is accurate and clearly presented.

- Send: Send the invoice to your client using their preferred method (email, mail, etc.). Consider following up with an email or call to confirm receipt.

Creating a construction invoice requires attention to detail and understanding the project and agreement terms. By following these steps and customizing the invoice to the specifics of the work and client requirements, you can ensure that your invoices are professional, accurate, and effective in facilitating timely payments. Whether you use a template or specialized software, the key is consistency in your invoicing process and clear communication with your clients.

What does a construction invoice look like?

Here is an example of a real-life construction invoice:

Free Construction Invoice Template

Download a professional construction project invoice template you can use in your construction project invoicing process.

Free Construction Invoice Template

Related posts

Read our other articles where you can find useful and relevant information about construction invoicing:

About the Author

Mikk Ilumaa

Mikk Ilumaa is the CEO of Bauwise, a leader in construction financial management software with over ten years of experience in the construction software industry. At the helm of Bauwise, Mikk leverages his extensive background in developing construction management solutions to drive innovation and efficiency. His commitment to enhancing the construction process through technology makes him a pivotal figure in the industry, guiding Bauwise toward setting new standards in construction financial management. View profile